Navigating the world of retirement planning isn’t easy, but everyone will eventually do it as they get older. Luckily, it’s easier when you know which retirement planning mistakes to avoid. Identifying them is the first step in avoiding them. From that point, you can plan for retirement and thrive in your later years.

One of the most common financial mistakes people make is not saving enough for retirement. Often, people underestimate the amount of money they will need to live comfortably after they stop working. The key to living a worry-free retirement lies in saving diligently and early in your career. Consistently contribute to your retirement savings, taking advantage of compound interest over time. Careful financial planning like this helps you build a substantial nest egg that can help you enjoy a well-deserved and comfortable retirement that’s free from financial stress.

Inflation is easy to underestimate when planning for retirement. Many people forget to consider that the cost of living is not static—it will invariably increase over the years. This steady rise in prices can erode the purchasing power of your savings, making what once seemed like a substantial amount insufficient for future needs. Thankfully, you can skirt the hazards of inflation when you factor it into your calculations and develop a more accurate and sustainable retirement plan.

A large family home might hold sentimental value but can be financially imprudent due to maintenance costs, taxes, and utilities. Downsizing or considering alternative living arrangements, such as co-housing, can significantly reduce your living expenses, allowing for a more flexible and economically sustainable retirement.

One option many homeowners fail to consider is living tiny. There are plenty of reasons why you should retire in a tiny house, making your retirement much more minimalist. When you downsize to a tiny home, your retirement can be simple. Instead of a big house full of clutter that wears on your mind, you can live free from possessions and travel freely in your later years!

Carrying substantial debt into retirement can impair your financial flexibility and peace of mind. High levels of debt mean more of your retirement savings will go toward paying them off rather than funding your desired lifestyle. Before retirement, prioritize debt reduction. When you pay down debts, you can boost your financial security and avoid the stress that comes with a debt-filled retirement.

When you learn to avoid these retirement planning mistakes, you can embrace the golden years of retirement and avoid financial worry!

24World Media does not take any responsibility of the information you see on this page. The content this page contains is from independent third-party content provider. If you have any concerns regarding the content, please free to write us here: contact@24worldmedia.com

U.S. Lags Behind Other Countries in Hepatitis-C Cures

Bill Harris: Omega-3 – A Simple Way to Lower Your Risk of Disease

Chasing a hockey dream together: How Luke and Sophia Kunin make the first NHL-PWHL marriage work

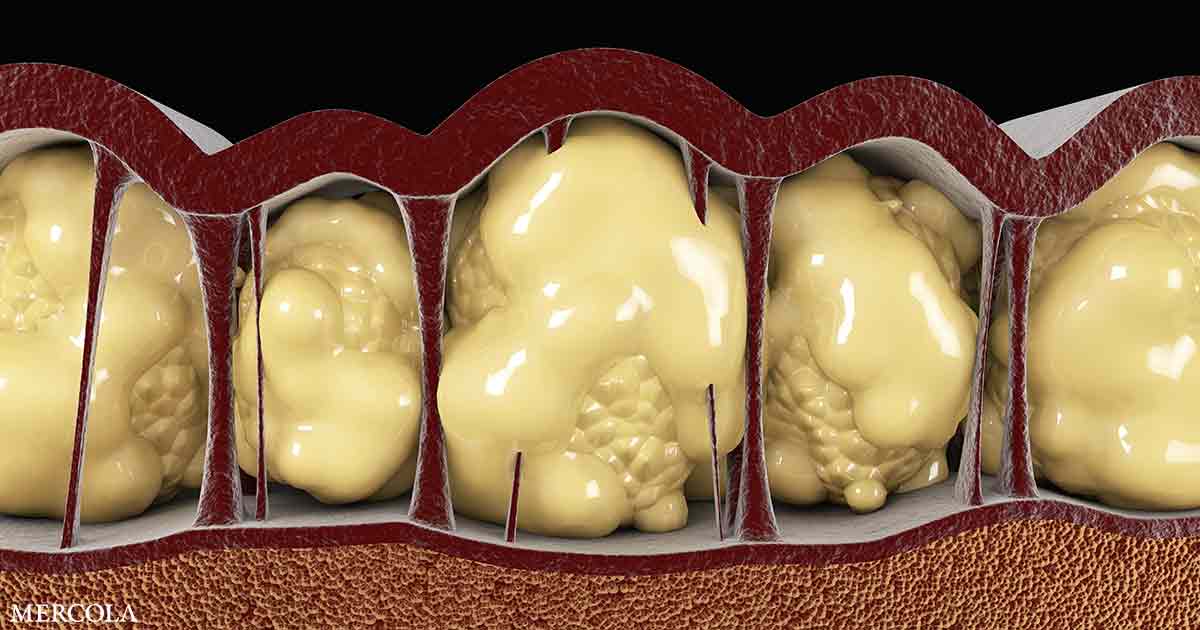

Why Constipation Is on the Rise

Mistakes To Avoid When Planning for Retirement

‘To the Future’: Saudi Arabia Spends Big to Become an A.I. Superpower

Antidepressants: What to Know About Uses and Side Effects

Is Eating Eggshells Beneficial?

How hockey helped make J.J. McCarthy one of NFL Draft’s most intriguing prospects

Aspartame Classified as 'Possibly Carcinogenic'

What To Check When You Find Fluid Leaking From Your Car